This is a chapter from Cassandra’s Memo, latest download available free HERE. And HERE is more good news from Florida.

The Bitcoin advocates say it can defeat the central bankers. It is an electronic currency invented in 2008 that is currently classified as a commodity like gold. This means that capital gains tax is due when it is sold.

We know its structure is robust because it has been tested repeatedly by sophisticated hackers throughout its existence. If they were able to penetrate Bitcoin, their reward would be billions of dollars. Many serious people have worked a decade on Bitcoin’s structures including the “wallets,” the “mining,” and the exchanges.

The total number of Bitcoins has an absolute limit of 21 million, and about 19 million exist now. This is locked into the source code. Because the supply is limited, it cannot inflate. Bitcoin is outside of banks or other central control. It exists in thousands of computers worldwide—the most massive computer network ever built.

Game theory says people hold more secure currencies and spend less secure ones. This means that the good ones cannibalize the inflating ones. This has so far proven true for Bitcoin, and its usage and price have increased for over a decade. It is the best-growing asset class—ever—and has appreciated faster than any stock in history.

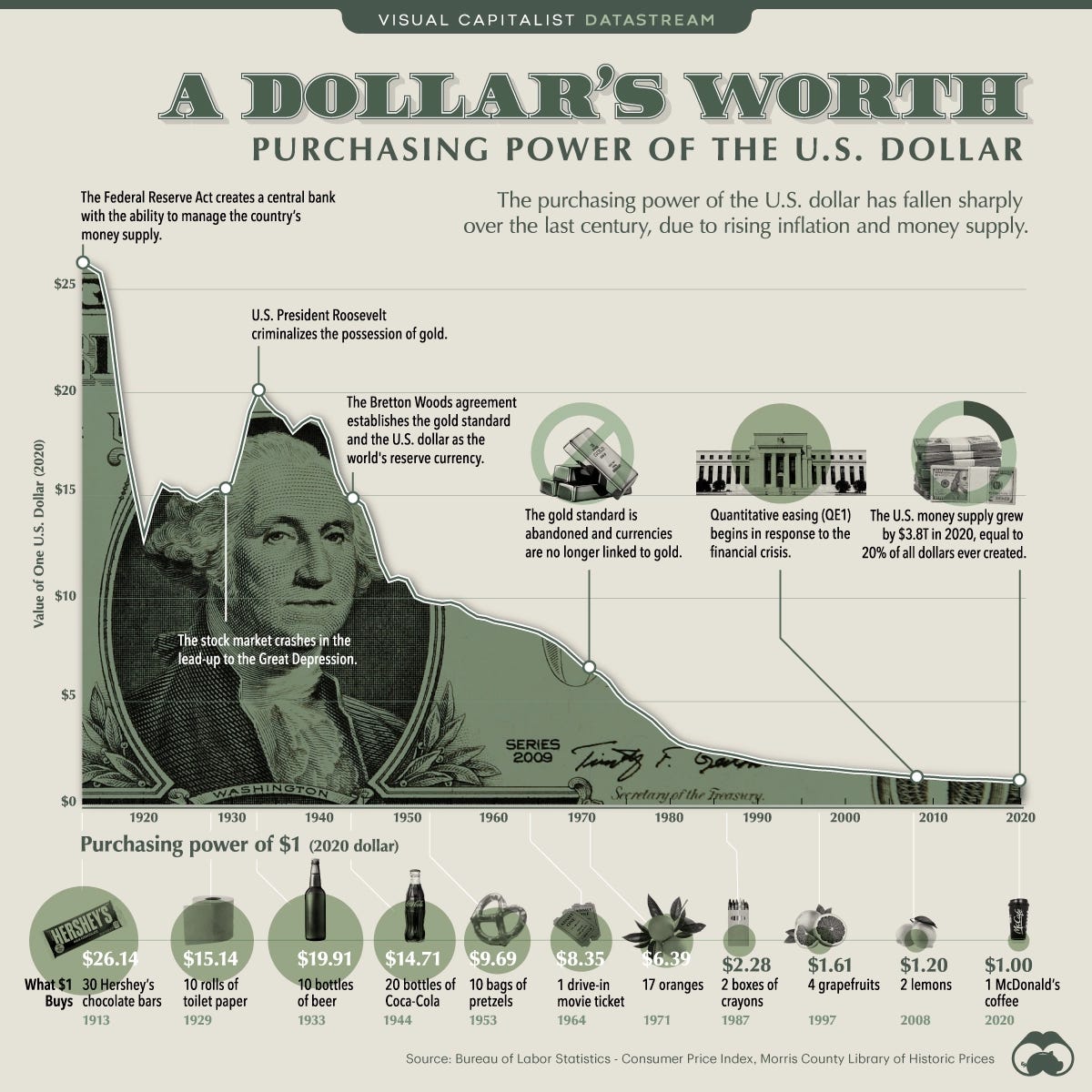

Hyperinflation destroys both the money and the economy. For example, the value of Venezuelan currency has wasted away. Shops there cannot get essentials and are left empty. The following chart shows what has happened to the dollar over the years as its value was purposely destroyed.

Gold has been used as money for millennia and is the oldest and best-recognized store of value. Bitcoin has many similar features and some that are superior. These include portability and near-instant transferability. These two assets and real estate are the most likely to hold value against inflation.

A simple technical analysis of scarcity called "stock to flow" is the ratio of the total stock of gold to the amount of new gold mined. Bitcoin is "mined" with computers just like gold is mined in the earth. This analysis can be done for either asset, and the result is nearly identical.

Bitcoin's price volatility is worrisome, but its trading volume is in the top five exchangeable currencies worldwide. It is used for settlements that are trillions of dollars each year, and this increases year over year. Worldwide Bitcoin transfers are about the same as the huge Fedwire system. Their website says:

[We are] the premier electronic funds-transfer service that banks, businesses and government agencies rely on for mission-critical, same-day transactions. Fedwire Funds Service participants benefit from the finality of payments credited to their Federal Reserve Bank master accounts.

Bitcoin has had no technical issues since 2013. Its development is slow, deliberate, and focused on security. Its secrecy is imperfect but being developed.

People in inflation-prone countries have trouble finding stores of value to save their money and investments. Many instantly understand Bitcoin’s promise, for they know that their currencies are like melting ice cubes. In notoriously corrupt Nigeria, for example, the central bank banned Bitcoin, but this is being ignored. They recently introduced a central bank digital currency, but it has yet to have much success against Bitcoin.

El Salvador and Central African Republic have made Bitcoin legal tender. Saint Kitts and Nevis is getting close. Some countries peg their currencies to the US dollar or actually use it. Because of inflation, mimicking the dollar only works in the short term.

Bitcoin’s market cap, the total value of it all, is $321.80 billion, down from $1.204 trillion a year ago. In comparison, all the gold in the world is worth about $12 trillion, and the total of all stocks have a market cap of about $92 trillion. Savvy investors are trying to get a small percent of their holdings into Bitcoin as an inflation hedge and for its upside potential. Any portfolio with a few percent Bitcoin has had far better returns over the past decade. If even one percent of all stock funds become Bitcoin, its price would soar.

There is a Bitcoin exchange-traded fund (ETF) on the Canadian stock exchange and several US stock proxies for holding Bitcoin. Alternatively, using wire transfers or credit cards, Bitcoin can be purchased directly from US exchanges. Bitcoin ATMs that change cash to bitcoin are in all major US and European cities.

Scandals and scams plague Bitcoin exchanges. For example, the fall of FTX destroyed eight billion in value. This has affected the price and confidence, but it was only a tiny percent of the total market cap, and the system has withstood several earthquakes like this. More worrisome is the evidence that the FTX fraud was an active attack on Bitcoin using a conman who was a member of the psychopath club. This POST is the best summary about the grifters, pedophiles (yes), and bankruptcy as of the end of November 2022. From the article:

The cast of characters… includes a mega-billionaire with enough influence to keep his life entirely off Wikipedia, a curious gathering of researchers at MIT, and also some familiar faces from the pandemic you might not have realized would pop up in the largest ever cryptocurrency catastrophe… Also Jeffrey Epstein… What I've gathered talking to people who have been around SBF (Sam Bankman Fried, the FTX CEO), superficially or closely… is that he's a spoiled, sadistic, hedonistic, ruthlessly dishonest bully of a manchild… [The plan was to:]

Step 1: Establish Alameda Research trading firm.

Step 2: Complete one kick ass trade.

Step 3: Build a well-projected media image of the Altruistic Death Star.

Step 4: Build the Death Star (FTX-Alameda).

Step 5: Explode.

Other crypto currencies have little promise, and Teather may be a worse disaster than FTX. The 2nd Smartest Guy in the Room states, “A simple crypto rule to live by: any token or exchange that has a CEO, identifiable individual or development team associated with it is not real crypto; it's the antithesis of crypto. [I have] been warning for quite some time that all of these centralized exchanges are nothing more than grifting operations, IRS reporting nodes and CIA black ops money laundering facilitators.” Peter McCormick calls all crypto but Bitcoin “s**tcoins.”

Bitcoin transactions are slow. Applications such as the Lightening Network are making Bitcoin faster, more scalable, and more accessible. Analyst Lynn Alden wrote a comprehensive article about this and its relationship to the currency HERE. The following is from her summary:

-Bitcoin started with a smart design from the beginning. It created an underlying digital gold and settlement network, with a credible degree of decentralization, auditability, scarcity, and immutability that no other network currently rivals. On top of that foundation, Lightning as a payment network is being developed, and has reached a critical mass of liquidity and usability.

-A truly decentralized and permissionless payment network [like Bitcoin] requires its own underlying self-custodial digital bearer asset. If instead it runs on top of the fiat currency system or relies on external custodial arrangements at its foundation, then it is neither decentralized nor permissionless.

-Many cryptocurrencies that followed in Bitcoin’s wake put the cart before the horse. They optimized for throughput and speed on their base layer, at the cost of weaker decentralization, auditability, scarcity, and/or immutability of the underlying bearer asset. As such, they failed to gain structural adoption as money and rendered their high throughput irrelevant, especially since they were brought into existence in the shadow of Bitcoin’s larger network effect.

-Volatility is inevitable along the path of monetization. A new money cannot go from zero to trillions without upward volatility by definition, and with upward volatility comes speculators, leverage, and periods of downward volatility. The first couple decades of monetization for the network as it undergoes open price discovery to reach the bulk of its total addressable market should be different than the “steady state” of the network after it reaches the bulk of its total addressable market, assuming it is successful in doing so.

-Taxes on cryptocurrency transactions, as well as the lower supply inflation rate of bitcoins compared to fiat currencies, results in Gresham’s law being applicable here. Most people in developed countries have an incentive to spend their fiat and hoard their bitcoin like an investment, at least in this stage of the monetization process. The exception is for the subset of people who specifically need Bitcoin/Lightning’s permissionless nature for one reason or another, or for whom the majority of their liquid net worth is in it.

-People in developing countries, with higher inflation and weaker payment and banking systems in general, have more of a natural incentive to use Lightning as a medium of exchange earlier on its monetization process. Indeed, adoption rates are rather promising in many of those regions. This isn’t surprising, considering that more people in developing countries have smart phones than bank accounts, in aggregate.

Other resources

Listen to podcasts such as What Bitcoin Did and read one of the books below to understand the basics. This requires about 20 hours.

The Bitcoin Standard: The Decentralized Alternative to Central Banking.

Thank God for Bitcoin: The Creation, Corruption, and Redemption of Money.

Bitcoin: Hard Money You Can't F*ck With: Why bitcoin will be the next global reserve currency.

About the comments: I know that I am an acquired taste. The friends I cherish are the ones who tell me when I am wrong so I can sharpen my messages against their critiques. The rule here is that you can be be as pushy as you want, but if I suspect you are insincere, I kick you off (this has never happened to date). It is free speech--sharp sticks are tolerated. When you test my assumptions, we get a chance to learn from each other. As I was writing Butchered by “Healthcare,” I had a wonderful critic (thanks, M!) who treated me like a retarded stepson. She always got the message across, and after I got used to her, I was never offended.